China’s Shanghai Composite Index ($SSEC) surged higher last week by roughly 13%, which was one of its largest 1-week gains over the past decade. There were solid economic reasons for the surge as China’s central bank approved measures to accelerate recent sluggish growth. The People’s Bank of China on Tuesday announced plans to lower borrowing costs, inject more funds into the economy, and ease households’ mortgage repayment burdens. Despite these fundamental positives for the China economy, I’d argue that the index remains challenged technically, however, as overhead price resistance and trendline resistance suggest the most difficult levels to overcome remain:

The top price chart shows trendline resistance near 3100 and the most recent price high at 3200, so it’s fair to say that this 3100-3200 range is critical in the near-term. If it holds as resistance, it leaves little upside potential for China stocks from here.

The bottom panel is a 10-day rate of change (ROC) and illustrates that this recent 2-week pop is just about as strong as any over the past 10 years. The black-dotted vertical lines highlight other similar 2-week surges and, in just about every case, the initial rallies weren’t very sustainable.

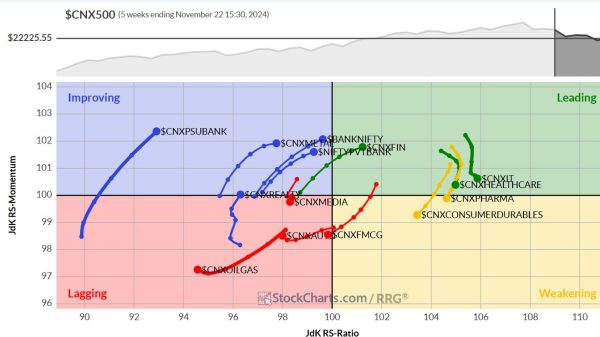

From a longer-term perspective, though, this is a chart that really bothers me with respect to the Shanghai Composite’s relative performance:

Can we really trust the recent rally? This is nearly 10 years of significant underperformance by the Shanghai Composite. Will last week’s fundamental developments really change China’s long-term relative performance? I don’t know, but I need to see more than one or two weeks of strength to be convinced.

There were many stocks that benefited from this China strength and I discussed some of those and much, much more on my weekly market recap video, “China Stocks EXPLODE Higher.” Check it out and be sure to “Like” the video and “Subscribe” to our channel.

Happy trading!

Tom