Recent critiques of international economics may surprise many actual economists. The latest rap against my profession is that we economists were too ideological and optimistic about the benefits of open trade and global markets while ignoring job losses, industrial decline, and economic distress in the United States. One recent op-ed went so far as to suggest trade policymakers do the exact opposite of what economists suggest. Recent tariff announcements from the Trump administration indicate this mindset may have already taken hold.

This narrative is seductive, but it’s also selective and false. Doubling down on protectionism will only entrench special interests who work to sustain a different, flawed system that delivers private gains at the nation’s expense.

To the frustration of many presidents, economists have earned their “dismal science” moniker by attaching ranges, uncertainty bounds, and warnings to their advice and predictions. While most economists would argue with certainty that there are overall gains from trade liberalization, they’re quick to add that there will be winners and losers.

But if you do the opposite by raising trade barriers, not only will there be winners and losers, there will also be net losses, along with new interest groups defending the protectionist spoils. An important objective of economics is to measure properly and attribute gains and losses, independently of which groups yell loudest.

Perhaps economists did not always emphasize the losses part of the ledger enough. It’s also true that many economists didn’t understand how long it would take for labor markets and displaced workers to adjust to shocks of any type, not just those from import competition. New research (from economists!) has shed light on the adjustment challenge, and—far from being bound to any ideology—my colleagues and I have quickly incorporated it into our work.

Yet this doesn’t mean the overall gains from trade were wrong—and economists have created a substantial volume of research and new models to better understand it. If anything, this new work shows that the gains from globalization are larger than we thought and would be more costly to dismantle.

In short, the focus has changed, but the consensus has not.

Over the past 40 years, the field of international economics has undergone a significant shift in its understanding of globalization’s effects. In the 1980s and 1990s, the dominant view was that free trade always led to net gains. Classical trade models based on the theory of comparative advantage suggested that while trade might cause short-term dislocations, the economy would adjust, reallocating resources efficiently and increasing overall productivity.

However, by the early 2000s, empirical research began to challenge the adjustment part of the equation. Studies on the “China Shock”—the surge in Chinese imports after China joined the World Trade Organization (WTO) in 2001—showed that certain labor markets in the US suffered lasting economic harm. Workers in industries relatively more exposed to Chinese competition faced prolonged unemployment and wage declines.

Suddenly, a raft of new research reexamined the issue from both sides. Some research showed many social costs of import competition shocks, and other work argued that jobs from new export market opportunities more than made up for the jobs lost in some sectors. There was substantial job reallocation in affected labor markets, but it was away from manufacturing and into service sector employment in R&D, management, transportation, and warehousing. Unfortunately, these new jobs were not in the locations or in the same sectors that lost jobs.

But here is the rub in the China Shock narrative: Economists devoted too much of their attention to explaining every nuanced and downstream causal effect of Chinese import competition. While spotlighting those effects was correct, they offer an incomplete story that has come to dominate the public narrative.

Economists know for certain that—contra the anti-globalization spin—import competition has not been the only driver of US manufacturing job losses since 1990, or 2001, or 2008. For example, during the Great Recession, the United States lost more than 2 million US manufacturing jobs, but imports collapsed too. Manufacturing jobs have been declining as a share of employment since the 1950s and in nominal terms since 1979. These declines began long before the US signed NAFTA in 1994 or China joined the WTO in 2001.

Germany, Japan, and many other industrialized nations have also seen manufacturing employment fall over the long term, and even China lost 6 million manufacturing jobs from 2013 to 2019. Why? Productivity gains from new technology and automation, i.e. robots, have reshaped manufacturing worldwide.

The main takeaway from the China Shock research agenda isn’t that trade has hollowed out American manufacturing or that protectionism is warranted today. Instead, when industries experience a large negative demand shock from whatever the source, job losses can persist and cause wider social harm. Thus, even if we waved a magic wand and decoupled from China as if it were 2001, the secular decline in manufacturing as a share of US employment would have continued, American workers would still not have moved to find new opportunities, and they might’ve struggled to find retraining, too.

The 21st-century manufacturing sector is not what it used to be, and that’s a good thing. Computers and electronics were 11 percent of value-added and 5 percent of gross output in manufacturing in 2023. Real, inflation-adjusted output in those higher-tech sectors rose 4–5 percent annually in 1997–2023. Some make the argument that output is declining if you remove computers, communications, and semiconductors—but that’s like saying the 1990s Chicago Bulls were mediocre if you deduct the points scored by Michael Jordan and Scottie Pippen.[1] Part of that gain may indeed reflect adjustments for computing power, but much of it isn’t. Other traditional manufacturing areas expanded too. Light trucks and SUVs grew at an annualized rate of 3.6 percent and in 2023 accounted for 2 percent of value added and 5 percent of gross output.

Industries rise and fall, and new ones take their place. There is no rule that says the top sectors from the 80s and 90s should be frozen in time when there have been massive technological advances, in computing power (semiconductors), energy (horizontal drilling, solar, and wind), and medicine (pharmaceuticals and medical equipment). Regardless, the fate of manufacturing does not determine the direction of the US economy. The shifting composition of the American workforce reveals that comparative advantage is dynamic, not—as critics suggest—a failed concept. Workers and firms shift toward and specialize in the sectors where they are relatively more productive. In the long term, the economy is better off overall.

Eschewing self-sufficiency and keeping markets open has allowed the US to become a global leader in technology, services, and advanced manufacturing. General Electric no longer makes light bulbs; IBM specializes in cloud computing and software; 3M is a consumer goods innovator rather than a mining operation. On net, these are all good developments. So, while trade skeptics myopically target the manufacturing trade deficit as a sign of economic demise, they overlook that the US consistently runs services trade surpluses with the world, with over $1 trillion in services exports and a $280 billion trade surplus in 2023 alone.

We should continue debating globalization’s impact, but the modern protectionists’ case against international economics omits the areas in which the academic consensus remains fully intact—areas that undercut much of the protectionist argument.

Economists agree, for example, that one of the most overlooked advantages of an open economy is resilience. U.S. businesses do not operate in a perpetual state of readiness for the worst-case scenario, but they are perfectly capable of assessing risk and uncertainty. When a big shock hits, there may be shortages. Global supply chains provide access to critical goods and inputs that support economic stability, innovation, and growth.

The rapid production and distribution of COVID-19 vaccines showed this very thing—that access to global markets strengthens U.S. resilience rather than weakening it. Today, even the Trump administration has looked to imports to help mitigate egg shortages and lower prices, just as the economics literature would suggest.

Economists are also not wrong about tariffs. The only silver lining of the trade war is the hundreds of new textbook examples where theory fits reality to a T. Protectionism imposes long-term costs on businesses and consumers for the benefit of a select few industries. Studies have now shown that the U.S.-China trade war and other U.S. tariffs raised manufacturing costs, reduced exports, cost households hundreds of dollars per year, and did little to bring back manufacturing jobs or reduce trade deficits. The billions in tariffs collected from U.S. consumers was used to bail out politically powerful farmers hurt by foreign retaliation. Aside from a handful of protected workers and companies, everyone else was worse off.

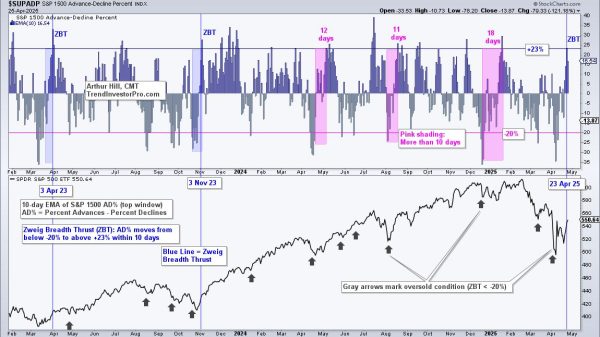

Economists also agree that, when it comes to policy, durability is critical and uncertainty hurts. When choosing policies to boost job growth and U.S. global competitiveness, one lesson from the backlash against globalization is that truly effective measures must be resilient across political cycles.

For instance, continuing to improve roads, bridges, ports of entry, and railway corridors offers value precisely because these investments are permanent. They reduce costs for businesses and people in every economic environment—regardless of trade policy, recessions, or shifts in political leadership. By contrast, economic policies implemented (and thus easily canceled) by executive fiat deliver less bang for their buck and keep private investors on the sidelines—a lesson we may again be learning as presidential tariff announcements fly and trade policy uncertainty skyrockets.

None of this means, however, that economists have no more work to do. We should offer a more comprehensive view of how trade impacts communities, how labor markets adapt, and which policies are most effective in disruptions—whether caused by trade or other shocks. This doesn’t contradict the broader consensus that trade delivers net gains, and we should do more to explain them.

But it also suggests we need to spotlight both benefits and costs to show how policy can help more people share in the gains. In an ideal policy world, “winners and losers” would become, at worst, “winners and less-disadvantaged.”

It’s a tall order, but international economics will keep improving and should not be abandoned for narratives unsupported by theory and reality. Instead, we need to tell the stories and narratives consistent with the broader evidence—evidence that still strongly supports globalization.

[1] I am using 1997–2023 data here because the Bureau of Economic Analysis produces detailed tables of gross output and value added in real and nominal terms at more detailed levels of industry disaggregation using the more modern NAICS encoding of industries. The focal point on excluding high tech industries seems to be the result of the Federal Reserve Board producing readily available special tabulations of industrial production that exclude high tech manufacturing, auto manufacturing, or both from aggregate industrial production. This is because the Fed Board needs to know what is happening in the new and old economy for making monetary policy, not international economic and trade policy. Data for best and worst performing manufacturing sectors in the EU show very similar patterns to the U.S.