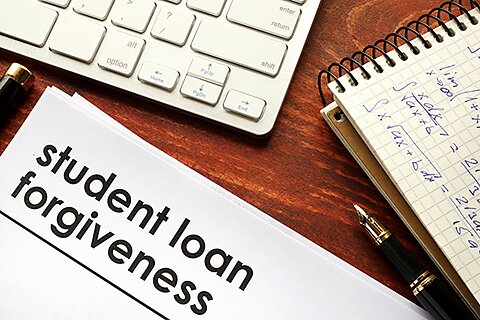

The Trump administration has issued a new executive order that limits eligibility for Public Service Loan Forgiveness (PSLF), a program that provides student loan forgiveness to government and nonprofit workers after 10 years of payments (other workers have to repay for 20–25 years, and some loans aren’t eligible for forgiveness at all).

The new order seeks to bar nonprofit workers from benefiting if their organization has a “substantial illegal purpose.” Some of the illegal purposes listed include aiding and abetting illegal immigration, supporting terrorism, performing transgender surgery on children, illegal discrimination, or engaging in disorderly conduct like obstructing highways.

The good aspect of the executive order is that it will constrict the size of PSLF. The PSLF is a badly designed program that should be shut down entirely.

To begin with, PSLF is badly targeted. The ostensible reason for the program is that government and nonprofit workers are underpaid. This premise is likely false, but even if it were true, loan forgiveness is the wrong remedy because it is so badly targeted, providing extra compensation only to those workers who took on student loan debt.

PSLF is also unfair. A nurse who works at a nonprofit hospital could get their loans forgiven in 10 years, but a nurse working for a for-profit hospital would have to repay for 20 or 25 years. In addition, PSLF provides massive windfalls for some borrowers. For example, the Biden administration used PSLF to forgive $78 billion in loans for one million borrowers, meaning the average beneficiary received a windfall of over $70,000. In comparison, the maximum Pell Grant, which goes to the lowest-income students, is $7,395.

The bad aspect of the new order is that a “substantial illegal purpose” can be easily twisted by policymakers to target the political opposition. For example, the order notes that “engaging in a pattern of aiding and abetting illegal discrimination” would be an illegal purpose. Under the current administration, this means that nonprofits that support Diversity, Equity, and Inclusion (DEI) could lose access to PSLF because many DEI practices are discriminatory. But the next progressive administration could reverse course, arguing that opposing DEI is racist, and therefore any organization that opposes DEI is abetting illegal discrimination.

To avoid this corrosive legal ping pong, all student loan borrowers should be treated the same. This applies to borrowers at pro- or anti-DEI organizations, but it also applies to borrowers working in the nonprofit sector or the for-profit sector. Rather than debate about which organizations are eligible for PSLF, we should get rid of PSLF entirely.