Electric vehicle marker Rivian is struggling to make cars and earn a profit, but it has proven adept at winning subsidy and tax credit packages from governments around the country. If the company cannot reverse its financial fortunes, it could go under before it uses all the incentives it has been offered.

According to Good Jobs First’s Subsidy Tracker, Rivian has gotten incentive packages from four states with an aggregate value of over $2.3 billion since 2016. The company started small, receiving $1.72 million from the Michigan Business Development Program to set up its corporate headquarters in Livonia, Michigan, and hire up to 170 employees. It later moved to the nearby city of Plymouth, Michigan, before transferring its headquarters out of state to Irvine, California.

In California, Rivian tried to obtain a $16.8 million California Competes Grant but was thwarted when two union representatives and a Rivian employee testified against it at a hearing of the committee overseeing the program. The employee complained of long hours, mandatory overtime, and frequent scheduling changes at the company’s Normal, Illinois, plant.

Rivian has also won $4.2 million of grant commitments in the state of Kentucky, where it has promised to “invest $10 million to establish a remanufacturing facility in Bullitt County, creating 218 full-time, quality jobs,” according to a press release from Governor Andy Beshear.

But Rivian obtained far bigger incentive packages from Georgia and Illinois. As discussed in my policy analysis “Reforming State and Local Economic Development Subsidies,” coauthored with Scott Lincicome and Krit Chanwong, Rivian obtained almost $1.5 billion in state and local incentives to build an electric vehicle plant in Stanton Springs, Georgia, that was supposed to open this year.

Hailing the deal at the end of 2021, Georgia Governor Brian Kemp said:

Rivian’s investment—the single largest in state history—represents the future of automotive manufacturing and establishes the leading role the Peach State will play in this booming industry for generations to come. Our Georgia Quick Start workforce training resources, world-class higher education institutions, and statewide logistics infrastructure assets are prepared to meet Rivian’s production and R&D needs. As one of the world’s most dynamic, innovative companies, Rivian’s exciting announcement begins a new chapter for Georgia, and we are honored to welcome them to the Peach State!

Unfortunately, this investment has yet to materialize and may never do so. In March, Rivian announced that it was pausing construction of the Stanton Springs facility and now says that the plant will not begin until 2028. Even that date depends on whether Rivian receives a federal loan under the Department of Energy’s Advanced Technology Vehicles Manufacturing Loan Program.

Although most of the Georgia incentive package kicks in when Rivian goes into production, state and local governments have already incurred soft and hard costs that cannot be recovered. These include a rent-free ground lease the state gave Rivian on the 1978-acre (or roughly three-square-mile) plant site and three access road construction projects the the Georgia Department of Transportation (GDOT) has initiated at a total cost of over $180 million (cost data from three projects come from GDOT).

With the Georgia plant in abeyance, Rivian continues to produce all its vehicles in Normal, Illinois. In 2017, Rivian bought a shuttered Mitsubishi manufacturing facility in the Central Illinois community after receiving $49 million in state tax credits and city property tax abatements worth $4 million over five years. In May of this year, Rivian received an additional $827 million incentive package from the State of Illinois Department of Commerce and Economic Opportunity to significantly expand the facility.

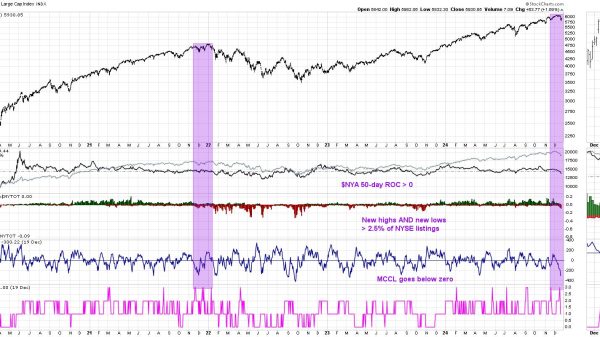

Whether Rivian can complete its Illinois expansion and build its new facility in Georgia rests in part on company performance—and this has not been promising. In the quarter that ended September 30, 2024, Rivian produced only 13,157 vehicles and delivered just 10,018. Production was down from the prior quarter due to a parts shortage. Worse, Rivian loses money on each vehicle it sells, although these losses have narrowed from $124,162 per vehicle at the end of last year to $32,595 in the second quarter of this year.

As a result, investors have soured on the company’s prospects, driving the company’s stock price down by more than 80 percent from its 2021 initial public offering price of $78 per share. Unless the company can increase production and sales while reducing costs per vehicle, it is likely to burn through its cash reserves and be forced into bankruptcy. In that event, the jobs that states expected to create from assisting Rivian will fail to materialize.