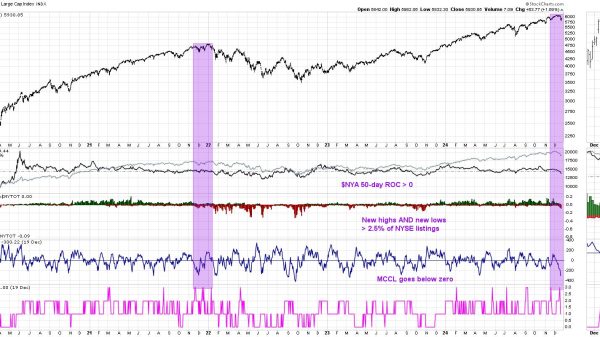

Monday saw something of a bloodbath on Wall Street, with the Dow ($INDU) plunging over 500 points at its worst and the S&P 500 ($SPX) and Nasdaq ($COMPQ) falling over 1%.

Monday saw something of a bloodbath on Wall Street, with the Dow ($INDU) plunging over 500 points at its worst and the S&P 500 ($SPX) and Nasdaq ($COMPQ) falling over 1%.

Higher oil prices, triggered by tensions in the Middle East, played a big hand in Monday’s market mayhem. In the blogosphere, other topics like a historic crude oil short squeeze and fears of a looming Israeli attack on Iranian oil and gas infrastructure made the headlines.

Is it time to go long? With oil spiking, could there be an opportunity to ride the wave with gasoline, given the usual lag? How high could oil climb? And with the current geopolitical tension, could we see a longer uptrend in oil or gas? What levels should you keep an eye on?

Let’s pause and break down what’s happening with oil and gas prices in technical terms.

What’s Going On with Oil Prices?

Below is a weekly chart presenting a five-year lookback on oil, using the US Oil Fund (US) as a proxy.

CHART 1. WEEKLY FIVE-YEAR CHART OF USO. Zooming out a bit, the level of fear in the market might not seem dramatic when you look at price action. USO is trading sideways with clear support and resistance levels.Chart source: StockCharts.com. For educational purposes.

Following the dramatic 2020 drop and 2022 peak, crude oil has traded sideways. The range may have been rather wide, but, directionally, it’s been sideways nevertheless.

- The magenta rectangle highlights a stabilizing range of support and resistance.

- Price has moved above and below the 50-week simple moving average (SMA) in a whipsaw fashion.

- In terms of momentum, the Money Flow Index (MFI) is showing a dip in buying pressure, just like the Chaikin Money Flow (CMF), even with the recent uptick in buying (check out the magenta circle).

The broader structure here shows that the current price surge is still relatively minuscule compared to the structure itself. But that doesn’t mean geopolitical events can’t drive prices above the current resistance level of around $83 or lower to its support at $64.

A close below either level would signal a broader fundamental driver and potentially the beginning of a longer-term trend.

Let’s switch to a daily chart for a more near-term view.

CHART 2. DAILY CHART OF USO. If the price continues higher, there will be a lot more resistance up ahead. Note the multiple support levels as well. These could trigger a price bounce.Chart source: StockCharts.com. For educational purposes.

This might not be unusual for wide long-term trading ranges, but you can spot plenty of ceilings (and floors) ahead.

- The Relative Strength Index (RSI) is rising and not quite yet at overbought territory, meaning there’s still room to run. But how much higher can it go?

- Look at the volume spike toward the bottom of the chart. It’s quite significant, but what’s perhaps more critical is the follow-up in volume as well as price, and so far, it isn’t there (yet).

- The CMF reading doesn’t show anything extraordinary in measuring buying pressure.

- If you’re curious as to the effect of crude oil prices on the broader energy sector, the energy sector’s Bullish Percent Index (BPI), a breadth indicator, tells us that over 60% of energy stocks are displaying P&F (Point & Figure) buy signals, which is, as you might guess, bullish.

Watch this: Focus on the multiple levels of resistance. Will volume and momentum drive USO beyond these levels? That’s a matter of geopolitical developments, none of which anyone can predict. However, sentiment can drive prices higher even without fundamental validation. And if this happens, it can last beyond the coming election, particularly if the question of an attack on Iranian energy infrastructure remains at the forefront of investors’ minds.

Also, mind the multiple levels of support (see black dotted lines), as several are likely to trigger a bounce.

What’s Going On with Gas Prices?

So, how might the rise in oil prices affect gas prices? Here’s a daily chart of the US Gasoline Fund (UGA) for comparison (UGA will be the proxy for gas).

The answer is, nothing yet.

CHART 3. DAILY PRICE OF UGA. Note the correlation in the indicator window above the chart. It’s showing a 99% correlation between UGA and USO.Chart source: StockCharts.com. For educational purposes.

When it comes to gasoline prices, there are two things to consider:

- Lag time. There’s a relative lag time between oil prices and gasoline prices. This can take two to four weeks, depending on supply chains, refining processes, and distribution networks.

- Market sentiment. Futures traders, especially, can push prices up in anticipation of a significant rise in crude oil, disruption to supply chains, refining, and distribution.

If this is what’s happening in UGA, there’s hardly any volume behind the move (see magenta circle). The lack of buying pressure, as displayed by the OnBalance Volume (OBV) indicator, agrees with this.

Another thing to watch: Investors wonder if the recent spike in crude oil will lead to a rise in gas prices. In other words, did crude oil and gasoline temporarily de-correlate? Looking at the StockCharts Correlation Coefficient indicator above the chart, you’ll notice that both commodities are still at a 99% correlation.

So, if you were hoping to take advantage of the lag between gasoline and crude oil prices, then price-wise, it isn’t there as of this moment (according to the indicator).

At the Close

To wrap things up, oil is spiking in the near term. In the bigger picture, however, it’s still trading sideways, and resistance levels are about to be tested. While gas prices usually lag, its price remains correlated to oil’s price surge, and, to date, there’s no significant volume driving it up (unlike crude oil). The big question is whether geopolitical risks will push prices higher. Sentiment can drive up prices even if that means getting ahead of fundamentals. Thus, you should keep an eye on the current technical levels and indicators. You’re likely to see a sharp response in those, as you would in any news item that might cause investors to jump.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation or without consulting a financial professional.