Germany’s constitutional debt brake, or Schuldenbremse, is a critical fiscal policy tool designed to limit structural government deficits. Instituted in 2009 following the global financial crisis, the debt brake has returned German public debt to sustainable levels while providing a fiscal anchor for the country’s economy. In contrast, the United States lacks such a fiscal brake, and the consequences of unrestrained spending are stark.

This week I’ll be on a panel at the Prometheus Institute Open Summit in Berlin, debating the German debt brake, fiscal policy, and MMT (officially, modern monetary theory, but referring to this pseudoscience as a magic money tale is more apt). I’ll be sharing insights from the US experience relevant to the German context. As Germany debates changes to its fiscal rules following a temporary loosening during the pandemic, there are critical lessons to be drawn from the US experience with unchecked deficit spending.

The German Debt Brake: A Resounding Success

The debt brake has helped place Germany on a more sustainable fiscal footing. Under Angela Merkel, the long-serving Christian Democrat chancellor who was often endearingly referred to as “Mutti” (Mother), the country consistently ran balanced budgets for six years in a row—commonly referred to as the schwarze Null (black zero). By 2019, Germany’s debt-to-GDP ratio had dropped to a manageable 60 percent, a significant improvement from the heights reached during the global financial crisis. This achievement wasn’t just a fiscal success; it marked the culmination of 10 consecutive years of strong economic growth and the highest levels of employment since German reunification.

The US Debt Crisis: A Cautionary Tale

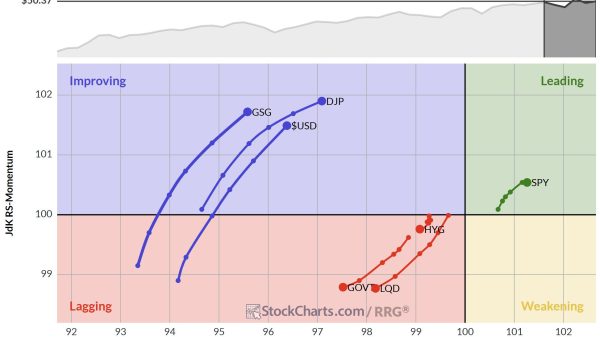

Meanwhile, the United States faces a ballooning debt crisis, with public debt just shy of 100 percent of GDP at $28 trillion ($35 trillion if you add in debts owed primarily to Medicare and Social Security) and projected to rise sharply in the decades ahead. Despite this brewing fiscal crisis, US policymakers consistently fail to address the structural drivers of debt, rising health care spending and old-age benefits like Social Security, as temporary funding battles over annual defense and nondefense appropriations distract legislators from bigger challenges. This lack of fiscal restraint has left the economy vulnerable to higher interest rates, with interest costs now the biggest driver of growth in the budget deficit. The results are reduced investment and slower economic growth, as government deficit spending crowds out private initiatives.

Running Up Against Fiscal Limits with No Debt Brake

The United States illustrates the peril of allowing short-term political priorities to undermine long-term fiscal sustainability. Without a debt brake or similar fiscal rule, US politicians have repeatedly deferred hard choices about tax and spending policy. Now mounting debt-servicing costs crowd out spending on other priorities, with the Congressional Budget Office (CBO) projecting net interest to rise significantly absent corrective actions.

This year, interest on the US debt is set to surpass defense spending of $849 billion. Under highly optimistic assumptions that don’t account for expected congressional adjustments to tax and spending policies, the CBO projects that US debt will reach 122 percent of GDP by 2034. Looking out further, the CBO highlighted that rising debt could reduce per-person income by $14,500 by 2054, assuming the debt grows to nearly three times the size of the economy. Excessive government debt hampers economic growth by crowding out more productive investments that enhance living standards, saddling future generations with higher costs while reducing their economic opportunities. Additionally, rising debt reduces economic flexibility, which limits the government’s ability to respond to future crises.

Germany has its own set of economic problems, including high energy costs, excessive red tape, and expensive public pensions given rising old-age dependency. Yet even after betting on Russian oil and gas imports backfired, rapid population aging drove up public pension costs, and an excessive bureaucracy hampering investment and job creation, Germany is a fiscally responsible front-runner compared to the United States. This is largely due to its debt brake, which caps structural deficits and helps stabilize debt levels over the long term.

Do Not Abandon Fiscal Discipline in the Name of Investment

Germany faces growing pressure to relax or even abandon its debt brake after policymakers got a taste of what looser purse strings can buy when the pandemic allowed for greater debt accumulation. Proponents of higher deficits claim that the energy transition, greater defense needs, and rising social welfare demands necessitate more government borrowing. As is usually the case, such spending is being labeled as “critical investments.” The US experience demonstrates the dangers of abandoning fiscal discipline in the name of public investments with uncapped energy tax credits passed into law as part of the misnamed Inflation Reduction Act. These credits turned out to be far more expensive than what members of Congress thought they had enacted based on projections by official government watchdogs. And thanks to no real fiscal limits, higher costs are simply piled on top of rising debt.

Moreover, central government investment in infrastructure is often inefficient and counterproductive. Political considerations can shift funding to areas where it serves electoral ends rather than meeting market demand. Also, government projects rarely have the proper incentives to keep things on budget and on time. Infrastructure assets are often better managed by the private sector and state and local governments. Instead of subsidizing and intervening, governments should focus on regulatory reforms to reduce costs and encourage private investment.

Learning from US Mistakes

Germany’s debt brake is a testament to the power of fiscal discipline. Its constitutional framework provides a built-in restraint on government spending, forcing policymakers to prioritize and live within the country’s means. The United States, which lacks such a mechanism, practices unrestrained spending, which leads to spiraling debt, with no clear path toward fiscal sustainability. As Germany considers loosening its fiscal rules for good following several years of profligacy to combat pandemic-related economic weakness, it should heed the lessons from across the Atlantic—once fiscal discipline is lost, it’s hard to regain.

Instead of following the United States down the path of unchecked deficit spending, Germany should return to the debt brake, remembering its track record of success, and focus on easing red tape, reducing onerous taxes, and integrating immigrants faster into labor markets to spur investment and become an economic powerhouse once again.

Meanwhile, the United States should adopt clear fiscal rules to rein in unchecked deficits and secure economic opportunity for this and future generations. Effective fiscal rules can help control government spending, reduce public debt, and create a more stable economic environment that enables businesses and workers to thrive. By committing to fiscal responsibility, US legislators can boost confidence in the US financial system and ensure younger generations aren’t weighed down by excessive debt and the specter of higher taxes and inflation.

As the late Nobel laureate and economist James Buchanan and George Mason University economist Richard Wagner wrote in Democracy in Deficit, “Budgets cannot be left adrift in the sea of democratic politics.”